About Us

Where do the role players go, to get trusted, objective advice on ESG, sustainability and related priorities?

Where do company boards, regulatory authorities, investors and others go to secure independent, and neutral assessments and validations of the claims of their potential clients, partners and investment targets?

Whether you are responding to climate change, protecting resource use, embracing the circular economy or improving your business performance, governance and oversight, at Walker Reid Strategies, we have the team to help you.

At Walker Reid we reduce carbon footprint through energy incentives.

We assess and advise on ESG-related issues across the Board.

Environmental Data Collection & Management

Data has always been the fuel of sustainability programs, enabling us to track performance, report to stakeholders and drive improvement. Today, ESG metrics are having their big moment as investors, customers, and employees increasingly use them as a yardstick for measuring brand value.

As your materiality analysis and goals drive which metrics to track, you will want to consult well-established reporting frameworks to inform your data collection approach.

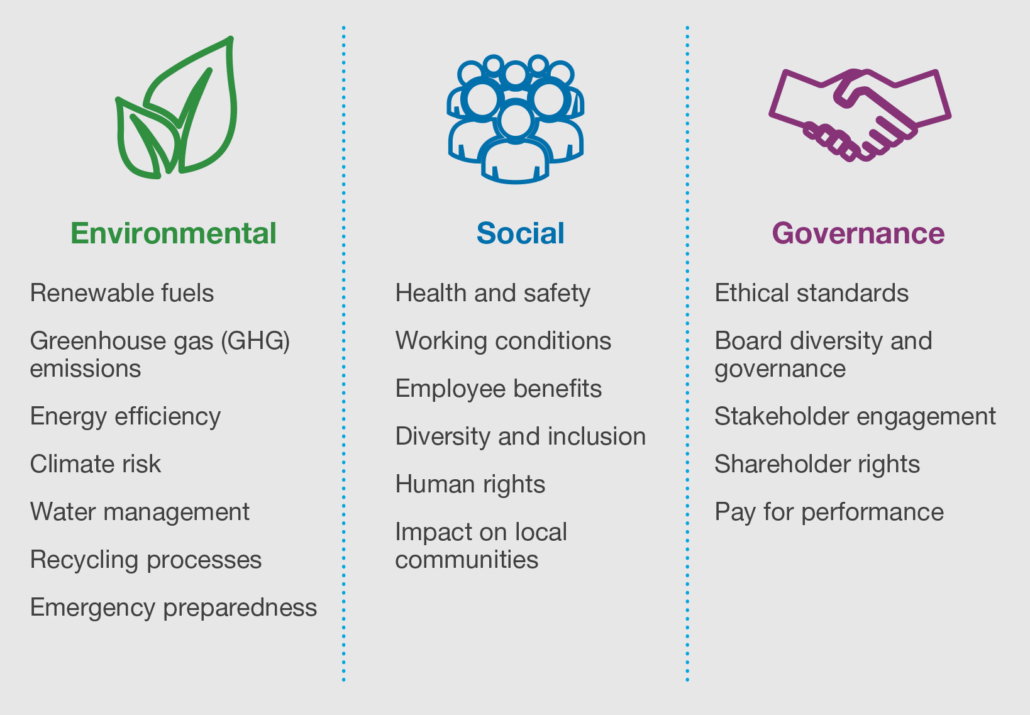

The data you source will fall into one these categories:

Environmental metrics are the most straightforward because they are established and well-understood. For instance, Walker Reid’s environmental disclosure platform which collects standardized information from businesses on climate change and other environmental risks have been in use for many years. Likewise, the Global Reporting Initiative (GRI) developed the widely adopted Sustainability Reporting Standards for ESG disclosures.

The practice of gathering social metrics is less mature partly due to privacy regulations and other challenges related to capturing personal data. Social data is also less defined and span a wide gamut from employment by gender and ethnicity to instances of safety incidents. Notably, efforts are underway to align disclosure, methodologies and standards to communicate impact on issues like human rights and labor practices.

Governance data is also becoming more well-defined amid more standard disclosures for ethics, governance and anticorruption.

At Walker Reid Strategies we pride ourselves on the use of the GHG protocol Methodology and attestation.

The GHG Protocol does the following:

- The corporate Accounting and Reporting Standard provides requirements and guidance for companies and other organizations, such as NGOs, government agencies, and universities, that are preparing a corporate-level GHG emissions inventory.

- Develops new guidance on how companies and organizations should account for greenhouse gas emissions and carbon removals from land use, land use change, bioenergy, and related topics.

- The Corporate Value Chain Accounting and Reporting Standard allows companies to assess their entire value chain emissions impact and identify where to focus reduction activities.

- Establishes comprehensive global standardized frameworks to measure and manage greenhouse gas emissions from private and public sector operations, value chains and mitigation actions.

Institutional investors are relatively advanced in the field of integrating ESG data into their organizations, compared to the rest of the market. Their collective interests lies not only in the Environmental Component but also increasingly in the social component as well. By measuring social impact, they aspire to add value to the social environment.

ESG Consulting

ESG consultations with Walker Reid Strategies provides the business, investment and policy communities with independent, consistent, and evidence-based strategic advice, as well as assessment of ESG performance, and validation of claims in the ESG profiles of companies.

We provide specialist support to in-house ESG due diligence and vast compliance terms. We work to advance sustainability and support the fight against climate change. This is something we are all behind at W.R.S.

We support government departments and regulators seeking to improve ESG accountability and transparency in business.

We work with great efficiency on data collection, and coverage to highlight your company’s strength’s and help to improve all aspects to the highest level of function.

We support investors to develop their own ESG purpose and strategy, and offer advice on exclusion screening, ESG-positive investments, and impact investing.

We assess the ESG performance of companies on behalf of investors or potential investors, company boards and leadership and regulatory authorities, validating claims against actual performance.

We develop ESG toolkits based on the requirements of company boards, investors and others to strengthen delivery of their ESG-aligned aspirations and commitments towards sustainability throughout.

Our Values:

- People first

- Community

- Transparency

- Accountability

- Sustainability